REMORTGAGE APPROVALS STEADY

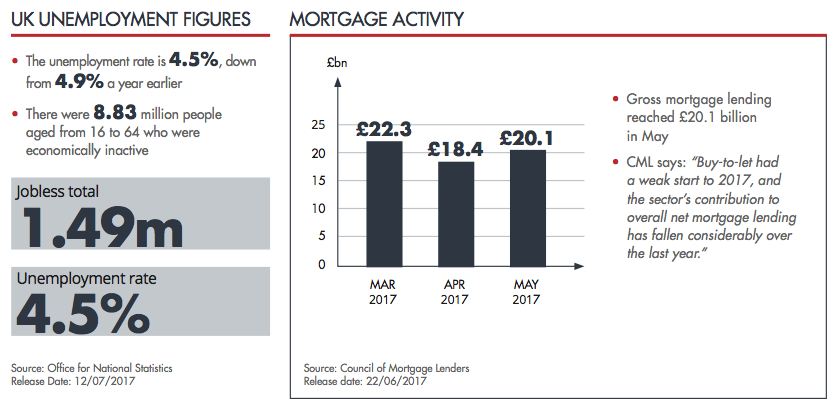

The Bank of England (BoE) reports that mortgage lending in the UK recorded an annual increase of 2.9% to May 2017.

The BoE also records 65,202 house purchases for May, up marginally from the 65,051 seen in April, but still below the six-month average of 66,990.

Remortgage approvals rose to 42,955, again higher than the last month’s figure of 40,437, but below the average of 44,069.

It is likely that this gentle decline can probably be put at the door of rising inflation and the subsequent squeeze on disposable incomes.

EACH NEW HOUSE BUILT ADDS £316,000 TO THE ECONOMY

Research from the consultancy group Arcadis, entitled ‘Building Homes – Making Places’, shows that each new house built in the UK generates £316,000 for the economy.

Their calculations state that £250,000 is created via taxes and job creation for each build, £53,000 into businesses through direct spending, with £13,000 going to local communities through the rise in investment into local services.

Regeneration spokesperson for Arcadis, Peter Hogg, said: “The benefits of building more homes are much greater than previously thought.” He went on to add that: “Following the shock election result, government must now work closely in cross-party cooperation to genuinely deliver on housing promises, along with devolved administrations up and down the country needing to take the lead around starting to build…”.

MORE POTENTIAL ‘DOWNSIZERS’ ARE LOOKING AT EQUITY RELEASE

As many as 17% of potential downsizers are now looking at switching to lifetime mortgages, a popular type of equity release, as an alternative option to raise funds. This has been prompted for many by the cost involved with moving house and the subsequent emotional upheaval caused by moving, combined with the possibility of having to relocate away from close family and friends.

Bower Retirement reports this in their latest ‘Adviser Tracker Research’, which also details that 55% of their canvassed advisers recounted clients changing their minds about downsizing because of the costs involved, choosing to investigate what equity release options are available instead.

WHERE NOW FOR THE HOUSING MARKET?

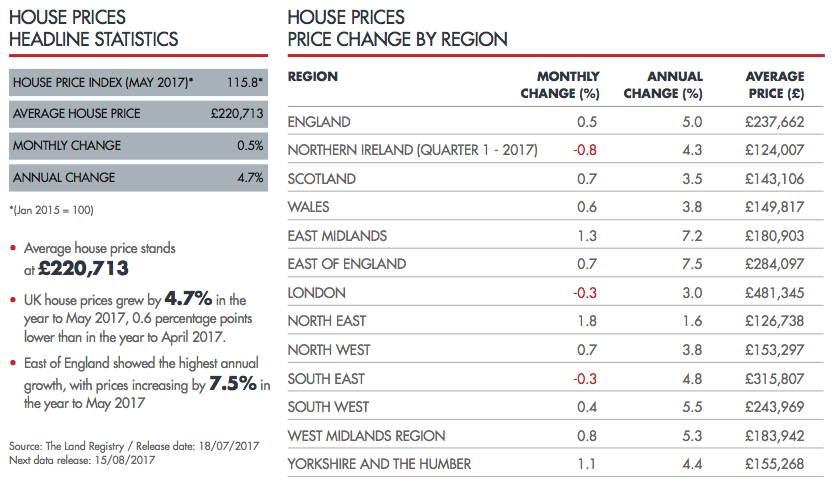

PwC’s latest UK Economic Outlook expects house price inflation to be 3.7% this year, down from 7% last year. London’s housing market will slow, with 2.8% and 3.8% growth on average in 2017 and 2018 respectively. With above average growth continuing in the east and southern regions of England.

Market analysts have different perspectives following the election result. The Head of Residential Research at JLL commented: “It will be crucial that the new champions of housing market policy in government can reaffirm commitments to the current policy direction.” He continued: “…the housing crisis deserves greater ambition and bold action from the new government. This requires cross-party support to de-politicise solutions and to provide longer-term backing for new solutions.”

The Sales Director of Seven Capital held the view that residential property “…will remain robust and resilient, delivering capital growth for investors.”

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.